All Categories

Featured

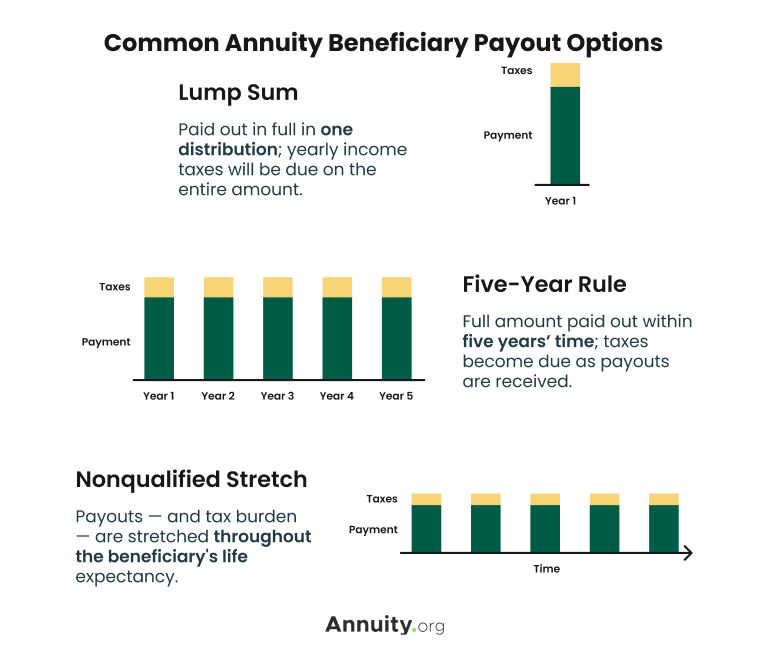

The finest selection for any kind of person ought to be based upon their existing circumstances, tax situation, and economic purposes. Lifetime annuities. The cash from an inherited annuity can be paid as a solitary round figure, which ends up being taxable in the year it is received - Annuity cash value. The drawback to this choice is that the earnings in the contract are dispersed first, which are strained as regular income

The tax-free principal is not paid out until after the profits are paid out.: The beneficiary can request that the earnings be annuitizedturning the cash into a stream of earnings for a life time or a set time period. The benefit is the settlements are just partially strained on the interest portion, which suggests you can defer tax obligations well into the future.:

Additionally described as the Life Span or One-year Policy, the nonqualified stretch option uses the beneficiaries continuing to be life span to calculate an annual required minimal circulation. The following year, the remaining amount of money is split by 29, and more. If there are multiple beneficiaries, every one can utilize their own life span to compute minimal circulations. With the stretch choice, recipients are not restricted to taking the minimum distribution (Retirement annuities). They can take as much as they desire as much as the whole remaining capital. If you don't have an immediate need for the cash money from an inherited annuity, you can choose to roll it right into an additional annuity you manage. Through a 1035 exchange, you can direct the life insurance provider to transfer the cash from your inherited annuity right into a brand-new annuity you develop. In this way, you proceed to defer taxes until you access the funds, either with withdrawals or annuitization. If the inherited annuity was originally developed inside an IRA, you might trade it for a certified annuity inside your very own IRA. Inheriting an annuity can be an economic benefit. Without thoughtful factor to consider for tax obligation

implications, ramifications could be might bust. While it's not possible to entirely stay clear of tax obligations on an inherited annuity, there are several ways to decrease existing tax obligations while making best use of tax deferment and raising the lasting value of the annuity. You need to not presume that any type of conversation or details contained in this blog site serves as the invoice of, or as a substitute for, customized investment suggestions from DWM. To the extent that a viewers has any questions relating to the applicability of any specific issue discussed over to his/her private situation, he/she is urged to speak with the expert expert of his/her choosing. Shawn Plummer, CRPC Retirement Organizer and Insurance Policy Agent: This private or entity is first in line to receive the annuity death benefit. Naming a primary beneficiary assists avoid the probate process, permitting a quicker and more direct transfer of assets.: Must the main recipient predecease the annuity proprietor, the contingent recipient will certainly receive the benefits.: This choice permits beneficiaries to get the entire continuing to be worth of the annuity in a single repayment. It provides instant accessibility to funds yet might lead to a substantial tax burden.: Beneficiaries can opt to obtain the death advantagesas proceeded annuity repayments. This alternative can provide a consistent income stream and might assist expand the tax obligation liability over a number of years.: Unsure which death advantage alternative supplies the ideal monetary outcome.: Anxious concerning the prospective tax ramifications for recipients. Our group has 15 years of experience as an insurance policy firm, annuity broker, and retired life organizer. We recognize the stress and uncertainty you feel and are devoted to helping you discover the ideal remedy at the most affordable expenses. Display modifications in tax laws and annuity guidelines. Maintain your plan updated for ongoing tranquility of mind.: Personalized guidance for your distinct situation.: Thorough testimonial of your annuity and recipient options.: Reduce tax liabilities for your beneficiaries.: Constant tracking and updates to your plan. By not collaborating with us, you risk your recipients dealing with considerable tax burdens and financial complications. You'll feel great and comforted, understanding your recipients are well-protected. Call us today free of charge advice or a cost-free annuity quote with boosted survivor benefit. Obtain annuity survivor benefit help from a certified monetary professional. This solution is. If the annuitant passes away before the payment duration, their beneficiary will certainly receive the quantity paid right into the plan or the cash money value

Taxes on inherited Fixed Income Annuities payouts

whichever is higher. If the annuitant dies after the annuity begin day, the beneficiary will typically proceed to obtain repayments. The response to this concern depends on the sort of annuity youhave. If you have a life annuity, your settlements will end when you die. However, if you have a certain annuity term, your settlements will proceed for the specified number of years, also if you pass away before that period ends. It depends on your annuity and what will certainly occur to it when you pass away. Yes, an annuity can be handed down to successors. However, some policies and policies have to be complied with to do so. You will need to name a recipient for your annuity. This can be done when you initially purchase the annuity or after that. No, annuities typically avoid probate and are not part of an estate. After you die, your recipients have to call the annuity firm to start obtaining payments. The business will certainly then normally send out the settlements within a few weeks. Your beneficiaries will receive a lump sum payment if you have actually a postponed annuity. There is no collection time structure for a beneficiary to assert an annuity.

It is generally best to do so as soon as feasible. This will ensure that the repayments are obtained immediately which any kind of concerns can be handled promptly. Annuity beneficiaries can be objected to under specific conditions, such as disputes over the validity of the beneficiary designation or claims of excessive impact. Seek advice from lawyers for assistance

in opposed recipient situations (Single premium annuities). An annuity survivor benefit pays a collection quantity to your recipients when you die. This is different from life insurance policy, which pays out a survivor benefit based upon the face value of your plan. With an annuity, you are essentially spending in your own life, and the death advantage is meant to cover any superior costs or financial debts you might have. Beneficiaries obtain settlements for the term defined in the annuity contract, which could be a fixed duration or forever. The duration for moneying in an annuity varies, yet it frequently falls in between 1 and 10 years, depending upon contract terms and state laws. If a beneficiary is crippled, a guardian or somebody with power of attorney will certainly manage and get the annuity payments on their part. Joint and recipient annuities are the two kinds of annuities that can prevent probate.

Latest Posts

Analyzing Strategic Retirement Planning A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Features of Smart Investment Choices Why Choosing the Right Financial Strateg

Breaking Down Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Annuity Fixed Vs Variable Breaking Down the Basics of Annuities Fixed Vs Variable Pros and Cons of Fixed Vs Variable Annuity Pr

Understanding Fixed Index Annuity Vs Variable Annuities Key Insights on Variable Vs Fixed Annuities Breaking Down the Basics of Variable Annuity Vs Fixed Annuity Benefits of Choosing the Right Financi

More

Latest Posts